Upside-down means you owe more on the car than it is worth. You may ask, "How can that be—" Easy. Let's say you buy a new car with for a price of $35,000. The various taxes, license and fees will add, as a rough rule of thumb, about 10 percent. The total is now $38,500. You write a check for a down payment of $3,000, which leaves $35,500 to finance. Over 60 months, depending on your credit rating and what sort of interest rate that allows, you will have monthly payments of, roughly, about $750, for a total of around $45,000. Add in the down payment and, by the time you're all done, assuming you keep the vehicle until it's paid off, you will have spent about $48,000.

How It Happens.

But the car's depreciation curve drops more quickly than the payoff curve. As soon as you drive it off the lot, otherwise known as "taillights over the curb" in the business, it's going to depreciate. Somewhere in that time you're going to be in a spot where it's worth, let's say, maybe $22,000, but you owe, let's say, $27,000. At that point you are $5,000 upside-down.

So let's say that at that point you want to buy a new car. You decide to trade in what was new only a couple of years ago. Let's say the new car has a price of $38,000, and taxes and so forth brings it to $41,800. You think the trade-in is worth something. It is. It's worth $22,000. But you owe $27,000. That $5,000 negative equity has to be covered somewhere. So, you wrap it into the price of the new car, which means the cost of the new one is now $46,800. You write a check for $4,000 for the down payment. You finance $42,800 for 60 months. That is, roughly, something over $850 per month. Total cost of the new deal, over $55,000, for a new car that will be worth about $35,000, maybe, the instant the happy salesperson sees "taillights over the curb." The outstanding amount of your payments is $51,000. You are, at that moment, $16,000 upside-down.

That amount is not, by the way, terribly extreme.

Understand it's not the dealership's fault that you're upside-down. You put yourself here. It was you who decided to buy those cars, you who decided to trade them in when you did, you who signed the deals.

Out-from-Under Tips.

So, the question is, how do you stop this vicious cycle? Here are some ways to get out from under being upside-down:

Most important, consider your automotive purchases more carefully in the first place. Look into what is known as the "residual," which is the projected, future resale value. Vehicles with higher residuals are less expensive to own in the long term, even though they may cost more up front, because they depreciate less; the total cost of ownership can be significantly less.

Purchase mainstream vehicles. The more specialized the vehicle, the more difficult it will be to sell in the future. A higher trim level four-door sedan, in a fairly common color like silver, will hold onto its value. A sports model, with a funky paint job, may not.

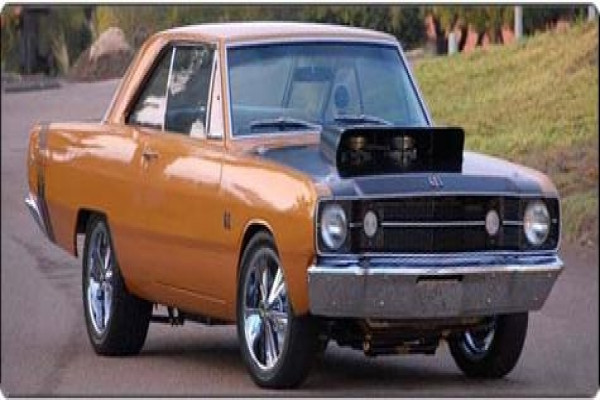

Do not personalize it with custom wheels, dark tinted windows, aftermarket sound systems, a loud exhaust system, lift kits and the like. Not only will you never get your money back for those things, in many cases they will actually detract from the value. They will certainly make the vehicle more difficult to sell in the future, because you will have to find a buyer whose taste in personalization is exactly like yours.

Resist the urge to keep buying new cars on a regular basis. Take care of what you have and hang onto it. Pay it off. If you've taken care of it, then it will bring more money when you sell it or trade it in. And if you've paid it off, you will then have some positive, rather than negative, equity. Then go shopping for another vehicle with some money in your bank account.

When you decide to get a new car, sell the old one yourself rather than trading it in. You'll have to spend a little time and money getting it cleaned up and ready for sale, but you'll get more in the bargain. Most people don't want to sell something themselves—they "don't want the hassle," they say. What's the hassle? Fixing it up and spending a few Saturdays waiting by the phone can result in several thousand dollars in your pocket. If you don't want the hassle, the dealership will be more than happy to take it in trade and make some good money on it. The guys at the dealership won't mind the hassle.